Navigating Uzbekistan’s money transfer systems: a guide to international and local payment solutions

With a growing need for both domestic and international financial transactions, Uzbekistan offers a range of money transfer systems. These systems cater to diverse needs, from sending remittances abroad to making local payments. This feature explores the most widely used money transfer systems in Uzbekistan, focusing on their fees, ease of use, and supporting real statistics to highlight their impact.

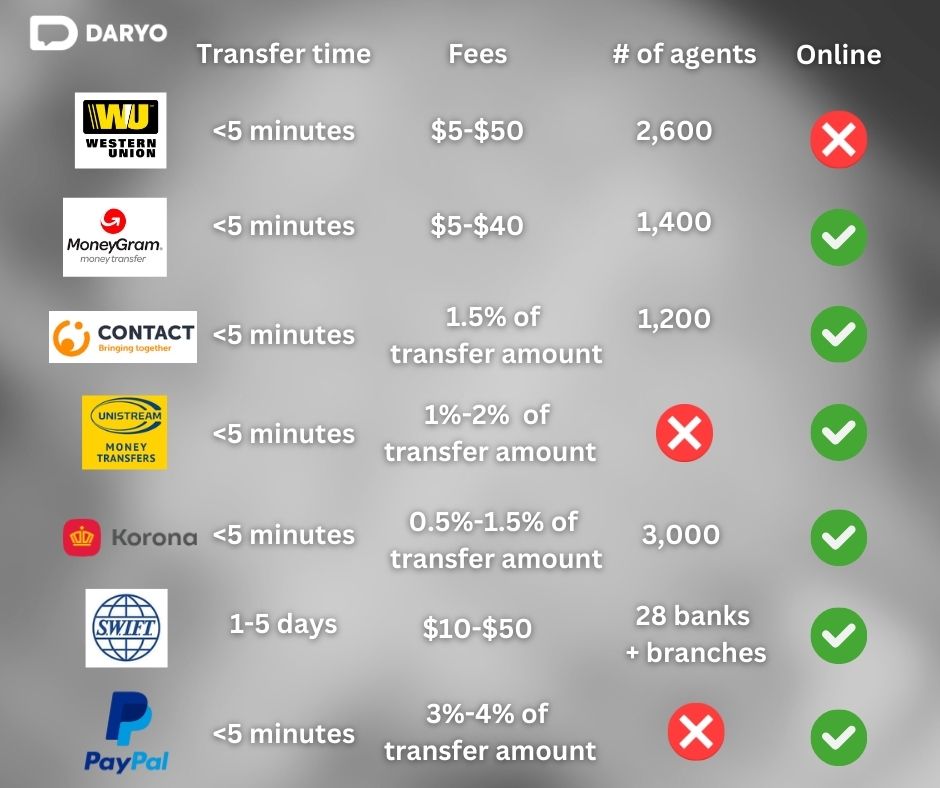

International Money Transfer Systems

1. Western Union

•Fees: Typically range from $5 to $50 depending on the amount and destination. For example, sending $200 from the U.S. to Uzbekistan incurs a fee of around $14.

•Ease of Use: Western Union is highly accessible, with over 2,600 agent locations in Uzbekistan, making it easy to receive remittances. (Online transfers not available in Uzbekistan)

•Use in Uzbekistan: Western Union is widely used for receiving international remittances. In 2023, Uzbekistan received $16.9bn in remittances, largely from Russia and the U.S..

2. MoneyGram

•Fees: Similar to Western Union, with fees ranging from $5 to $40, depending on the transfer amount and destination.

•Ease of Use: Available across numerous locations in Uzbekistan, MoneyGram is known for its fast service. It is ideal for smaller transactions.

•Use in Uzbekistan: MoneyGram is a common choice for remittances, especially from Russia, contributing to Uzbekistan’s remittance inflows, which amounted to 13.5% of GDP in 2021.

3. Contact

•Fees: Competitive, generally lower than Western Union and MoneyGram, starting at 1.5% of the transfer amount.

•Ease of Use: With a simple platform and widespread network, Contact is a popular choice for cross-border transfers. It offers fast, secure transactions, especially between CIS countries.

•Use in Uzbekistan: Contact is well-suited for transfers between Russia and Uzbekistan, given that Russia accounts for 80% of Uzbekistan’s remittance inflows.

4. Unistream

•Fees: Relatively low, generally ranging from 1% to 2% of the transfer amount.

•Ease of Use: Unistream is highly accessible and offers both online and in-person services. In 2022, it was used to send over $1.5bn in remittances to Uzbekistan.

•Use in Uzbekistan: Popular for Russia-Uzbekistan transfers, Unistream plays a significant role in the country’s inflows from the CIS region, with quick processing times.

5. Golden Crown (Zolotaya Korona)

•Fees: Typically 0.5% to 1.5% of the transfer amount, making it a cost-effective option for CIS countries.

•Ease of Use: Zolotaya Korona is available at over 3,000 service points in Uzbekistan, ensuring wide accessibility and fast transfer times.

•Use in Uzbekistan: It is one of the top systems for remittances from Russia, which make up $8.5bn of Uzbekistan’s total remittances in 2022.

6. SWIFT

•Fees: High, typically ranging from $10 to $50, often used for larger transfers such as business transactions.

•Ease of Use: SWIFT provides a reliable, secure platform but is slower than other services, with transfers taking 1 to 5 days.

•Use in Uzbekistan: SWIFT is commonly used by businesses for large international transactions, particularly in banking and trade sectors.

7. PayPal

•Fees: International fees typically range from 3% to 4%, but personal transfers within the country can be free.

•Ease of Use: While limited in Uzbekistan, PayPal is used primarily for receiving payments from abroad.

•Use in Uzbekistan: PayPal is growing, but it remains a niche service, often used for e-commerce or digital services.

Local Money Transfer Systems

1. Visa Direct / Mastercard MoneySend

•Fees: Low, generally between 0.5% and 1.5%, depending on the bank.

•Ease of Use: Transfers are instant and direct to a user’s debit card, making it a convenient method for domestic transfers.

•Use in Uzbekistan: Visa and Mastercard are widely accepted, with over 80% of Uzbek adults having access to debit or credit cards, making this a popular choice for fast, domestic transfers.

2. Click

•Fees: Minimal, often under 1% or free for certain services.

•Ease of Use: With over 13mn registered users in Uzbekistan, Click offers seamless mobile payments for utilities, shopping, and domestic transfers.

•Use in Uzbekistan: One of the leading mobile payment platforms, Click processes millions of transactions monthly, helping to digitize the country’s payment ecosystem.

3. PayMe

•Fees: Usually under 1%, with most basic transfers free.

•Ease of Use: PayMe is used by over 7mn users and integrates with major banks and service providers in Uzbekistan. The platform is highly popular for utility payments and peer-to-peer transfers.

•Use in Uzbekistan: Widely accepted in retail outlets and by service providers, PayMe is at the forefront of Uzbekistan’s digital payment revolution.

Choosing the Right Transfer System

When selecting a money transfer system in Uzbekistan, the choice depends on the type of transaction. For international transfers, services like Golden Crown, Unistream, and Contact offer competitive fees and fast service, especially within the CIS. Western Union and MoneyGram remain useful for global remittances, though at higher costs. For domestic transfers, Click and PayMe dominate the market, providing low-cost, convenient mobile options for everyday payments and transfers.

With remittances making up a significant part of Uzbekistan’s GDP, and the country seeing rapid growth in digital payments, the landscape for money transfers is more accessible than ever, offering a range of solutions to meet different needs.