lindsay_imagery

Investment thesis

Terex Corporation (NYSE:TEX) is a globally diversified manufacturer and distributor of aerial work platforms and materials processing machinery. It operates through two business segments: Aerial Work Platforms [AWP] and Materials Processing [MP].

In 2023, the global economy still confronts significant headwinds, and it appears that Terex actively manages them. The business encountered a volatile operating environment, including inflationary pressures, supply chain disruptions, and geopolitical unpredictability, such as fluctuating foreign exchange rates. Collectively, they caused production disruptions that were mitigated, among other ways, by increasing product prices and sourcing alternative suppliers. The effectiveness of the strategy was reflected in its performance in 2022.

Additionally, TEX backs the above strategies with a long-term strategy; Execute, innovate, and Grow. The Execute pillar is geared towards integrating new operational processes to improve efficiency. The consistent upgrade or new product offering and providing technological solutions are embedded in the ‘Innovate’ aspect, while ‘Grow’ is achieved primarily through acquisitions.

The business ended Q4 2022 with a total backlog of $1.2 billion, up 12% from the previous year. Strong client demand for products and services was reflected in a backlog almost three times the norm relative to prior periods. Both MP and AWP sales increased significantly from 2021 to 2022, from $2 billion to $2.1 billion and $2.6 billion to $2.7 billion, respectively. Additionally, net debt is still manageable at 1X, significantly lower than the 2.5X target. It has a solid balance sheet and liquidity amounting to $727 million. Given this background, I am optimistic about this company.

Macroeconomic headwinds

Like other businesses, TEX faced macroeconomic challenges, including inflationary pressures, supply chain disruptions, and geopolitical unpredictability.

It has multiple suppliers. Particularly affected by supply chain disruptions are business units with a sole supplier. Though they are not highlighted by name or as business entities, its SEC Filling disclosed that delays along the supply chain are attributable to limitations of the suppliers, such as suppliers’ financial distress, increasing costs, capacity constraints, and global logistics network challenges, such as shipping container shortages, international port delays, etc. Significant supply chain disruptions are also caused by fluctuations in the availability and cost of certain materials, resulting in decreased manufacturing efficiency, higher expenses, and reduced profits. The company has sourced alternative suppliers and adjusted production schedules to address this issue.

Regarding the inflationary pressure, the company is working on cutting costs through a cost discipline management scheme and engaging with its suppliers to reduce inventory costs.

Further, TEX bears a foreign exchange risk because its operations span multiple continents. The company’s financial statements are prepared in U.S. dollars. Changes in the value of assets, liabilities, and income expressed in currencies other than the U.S. dollar pose a risk. The currencies include the Euro, Chinese Yuan, British Pound, Australian Dollar, Indian Rupee, and Mexican Peso. Its financial projections may be affected by fluctuations in foreign exchange rates due to the continued volatility of foreign exchange prices relative to the U.S. dollar.

The company is proactively managing the uncertainties effectively in my view, as posted in the Q4 2022 performance, which I will discuss later.

Sustainability drivers

Sustainability generates long-term business value. Through its key theme of strategic growth priorities, the company has proved to drive tremendous growth in the future.

Execute

The Execute pillar is related to improving core business operation efficiency and accountability. The company managed to lower the SG&A to nearly 9% and 10% of sales through cost management principles in Q4 2022 and FY2022, respectively. In addition, the company is focused on Execute to Win approach to work around its challenges. For instance, it’s competitively compensating its employees to address labor challenges.

Innovate

The Innovate theme is inclined towards improving the product offering through design or developing new products. Terex India launched eight new products in 2022, some of which include;

1. FR 17 Pick and Carry Crane

The recently introduced FR 17 is a very compact pick-and-carry mobile crane from the Franna product line, designed specifically for the Indian market for applications requiring a hoisting capacity of up to 17 tons. This machine’s torque converter eliminates the need for a clutch lever, thereby reducing driver fatigue during long working hours. The crane incorporates safety and efficiency due to the high speed to get to job sites.

2. Powerscreen Hybrid Mobile Crushers and Screens

In collaboration with the Powerscreen brand, three products were introduced: Powerscreen Premiertrak 410E, Maxtrak 1010E Hybrid Jaw, and Cone Mobile Crushers. Powerscreen Hybrid offers consumers a flexible energy solution, as they may select their preferred fuel source based on factors like price, proximity to their operation, and availability. Customers in areas where electricity is less expensive than diesel fuel or locations where electricity is the preferred energy source will be especially interested in this choice. To further reduce fuel consumption and running expenses, Powerscreen Hybrid machines are equipped with a supplementary electric/hydraulic drive system that can be attached to an external electrical supply once the device has been set up onsite.

Grow

The theme is mostly achieved through acquisition. In August 2022, TEREX acquired ProAll, a specialist producer of voluminous mobile concrete mixers in Canada. ProAll’s volumetric mixers provide mobile concrete delivery that eliminates concerns over delivery time between a concrete plant and a job site by delivering products that are mixed locally and to the exact specifications of each job. Further, I believe the below strategies will catapult the company in the future:

Global megatrends

As major environmental shifts are inclined towards addressing climate change globally, Terex has positioned itself to benefit from such opportunities now and in the future. One is through Global Recycling Services, estimated to be nearly $220B/year as trash recycling demand rises by 2027. Secondly, are actions to reduce CO2 emissions. As 250M EVs are expected to be sold worldwide, Terex utilities are well-positioned to profit from electrical grid infrastructure upgrades that will reduce greenhouse gas emissions.

Growing the MP Segment

Its innovative products provide consumers with sustainable solutions. For instance, as part of the MP segment, Fuchs material handlers are versatile machines capable of handling various materials. Fuchs is diversifying significantly into port applications. Unloading bulk materials is a Fuchs material handler powered by a shift to a hybrid battery system. Due to the products, these vessels produced zero emissions and reduced harbor noise levels, reducing negative environmental impacts.

Expansion

The company is increasing its global footprint by establishing a presence in India. The country offers several benefits, including a highly competitive talent pool and the lowest possible manufacturing costs, making it ideal for exporting products and services to South Asia, the Middle East, and Africa markets.

Financials

Notably, the company delivered a 28% increase in operating income, a 41% increase in EPS, and a roughly 21% return on invested capital and achieved price cost neutrality for the year despite macroeconomic challenges.

Regarding sales by segment performance, MP had an outstanding Q4 2022 with strong operational execution resulting in $550M in sales, an increase of 21% compared to Q42021 due to robust customer demand across multiple businesses. The company ended the quarter with a total backlog of $1.2 billion, a 12% increase from the prior year. The solid backlog is approximately three times historical norms and supports sales projections for 2023. MP benefited from a favorable regional and product mix and successfully overcame cost increases to achieve price and cost neutrality. MP accounted for approximately 60% of Terex’s total operating income for the entire year and maintained its substantial revenue and operating margin performance.

AWP generated $672 million in revenue, up 26% from the previous year due to increased demand and pricing. The total backlog at the end of the quarter was a record-setting $2.9 billion, up 27 percent from the previous year. Customer demand remains robust because of high utilization rates, aging fleets, and electrification initiatives. The improvement resulted from increased sales volume, a favorable product mix, initiatives to reduce costs, strict expense management, and disciplined pricing decisions.

The Consolidated 2022 backlog bookings remained healthy and had the second-highest booking rate recently, with minimal cancellations and pushouts. The total backlog position was up 22% compared to the prior year, demonstrating the strength in end markets and providing Terex visibility into 2023.

The 2022 performance was characterized by substantial business growth and a strong balance sheet. Earnings per share increased 41% from $3.07 to $4.32, an increase of $1.25, including a negative impact of $0.42 per share from foreign exchange. It was growing sales by $4.4 billion by 14%. With a Free cash flow of $152 million, year-over-year growth was 21%.

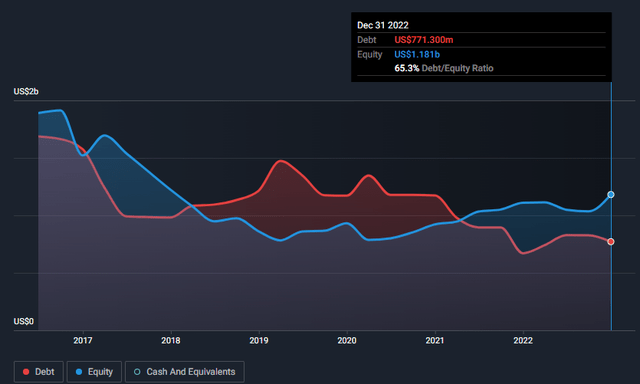

Moving to the balance sheet, Terex’s short-term assets ($1.96B) can offset the company’s long-term liabilities ($938M). The financial leverage remains low at once, well below the 2.5 times target. Terex has no debt maturities till 2026. Further, the company has ample Liquidity of $727 Million. Such a solid financial overview should give investors confidence in my view, as the portfolio seems not very risky and should translate into good returns.

Wall Street

Valuation

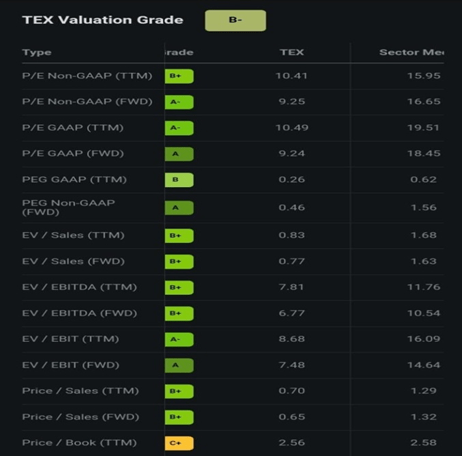

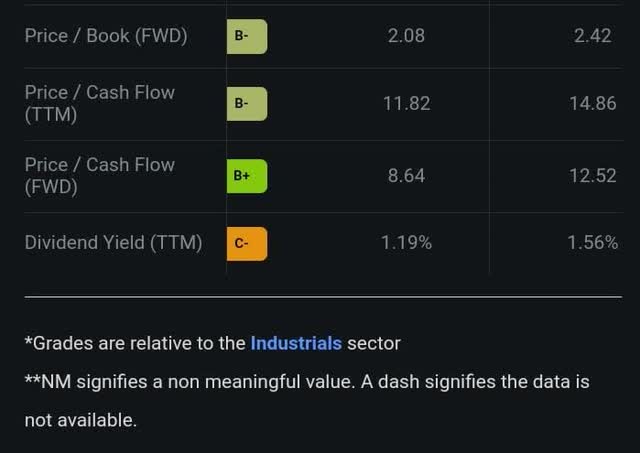

The company’s TTM-based PE, PS, PB, and PCF of 10.49, 0.70, 2.56, and 11.82 are all lower than their respective industry medians of 19.51, 1.29, 2.58, and 14.86, respectively. Based on this conventional valuation method, the stock is cheap since nearly all price ratios are below the industry median.

Seeking Alpha

Seeking Alpha

With the company being undervalued, I believe it gives potential investors a cheap entry point to this promising company.

Conclusion

Terex’s valuation solidifies the bullish case since the stock is undervalued, signaling growth opportunities for the company. The unique products arising in collaboration with established brands to develop innovative, customer-centric, and solution-based products are a competitive advantage. Further, the concrete measures position the company to benefit from the global trends in the future and offers sustainable income to investors. Over time the company has demonstrated resiliency and adaptability in an increasingly challenging environment coupled with strong market positions. Given the positives in this company, I rate it a buy, but potential investors should be wary of the headwinds which pose risk to their investment.