News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here.

|

SUMMARY PROSPECTUS |

September 3, 2020 |

|

AlphaMark Fund (AMLCX)

(Formerly the AlphaMark Large Cap Growth Fund) |

a series of the |

|

Before you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at https://funddocs.filepoint.com/alphamark/. You can also get this information at no cost by calling (866) 420-3350 or by sending an email request to [email protected]. The current Prospectus and SAI, dated September 3, 2020, are incorporated by reference into this Summary Prospectus.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 866-420-3350 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 866-420-3350. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this disclosure to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Fund complex or at your financial intermediary. |

|

INVESTMENT OBJECTIVE

The AlphaMark Fund (the “Fund”) seeks long-term growth of capital.

FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

Shareholder Fees (fees paid directly from your investment) |

|

|

Sales Charge (Load) Imposed on Purchases |

None |

|

Deferred Sales Charge (Load) |

None |

|

Sales Charge (Load) Imposed on Reinvested Dividends |

None |

|

Redemption Fee (on shares redeemed within 60 days of purchase) |

1.50% |

|

Wire Transfer Fee |

$15 |

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

|

|

Management Fees |

1.00% |

|

Distribution and Service (12b-1) Fees |

0.25% |

|

Other Expenses |

0.73% |

|

Acquired Fund Fees and Expenses(1) |

0.09% |

|

Total Annual Fund Operating Expenses |

2.07% |

|

Less: Management Fee Reductions(2) |

0.48% |

|

Total Annual Fund Operating Expenses after Management Fee Reductions |

1.59% |

| (1) | Restated and estimated for the current fiscal year to reflect current fees due to the change in investment strategy. Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies such as Underlying ETFs. The operating expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies. |

| (2) | AlphaMark Advisors, LLC (the “Advisor”) has contractually agreed, until December 31, 2021, to reduce Management Fees and to reimburse Other Expenses to the extent necessary so the “Annual Limit” of Total Annual Fund Operating Expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs; acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option fees and expenses); expenses incurred in connection with any merger or reorganization; |

1

extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s ) to an amount not exceeding 1.50% of the Fund’s average daily net assets. Management Fee waivers and expense reimbursements by the Advisor are subject to repayment by the Fund for a period of 3 years after the date of such waiver or reimbursement, but only if such reimbursement can be achieved without exceeding the lesser of: i) the Annual Limit in effect at the time of the waiver/expense payment and ii) any Annual Limit in effect at the time of the recoupment. This arrangement may be terminated by either party upon 60 days’ prior written notice, provided, however, that (1) the Advisor may not terminate this arrangement without the approval of the Board of Trustees, and (2) this arrangement will terminate automatically if the Advisor ceases to serve as investment adviser of the Fund.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and takes into account the Advisor’s contractual arrangement to maintain the Fund’s expenses at the agreed upon level until December 31, 2021. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 |

3 |

5 |

10 |

|

$162 |

$602 |

$1,069 |

$2,362 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 273% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

Under normal circumstances, the Fund will invest primarily in a portfolio of exchange-traded funds (“Underlying ETFs”) and individual equity securities that are a direct or indirect investment in large cap companies represented in the S&P 500 Index. The Advisor defines “large cap” companies as companies with a total market capitalization of $5 billion or more at the time of purchase. The Fund may also invest in securities issued by foreign companies that are listed on a U.S. exchange, including sponsored American depositary receipts (“ADRs”). During periods of volatility, the Fund may utilize the following option strategies with respect to options on individual stocks, ETFs or an index: (i) buy put options for a portion of the portfolio; (ii) write puts to generate income while waiting for a stock price to become more reasonable; and (iii) write call options to generate income on stock positions that the Advisor believes are becoming overvalued.

The Fund may invest in Underlying ETFs that primarily track the individual sectors represented in the S&P 500 Index. The Advisor seeks to invest in Underlying ETFs or individual equity securities that it believes represent the best risk-adjusted investment options. ETFs offer diversification and, therefore, reduce the inherent volatility of individual stock selections. The Fund may also invest directly in common stock and may hold preferred stock received as part of a corporate action.

The Advisor continually monitors global market conditions and the valuation of specific styles to determine the allocations of the holdings in the Fund. The Advisor utilizes valuation metrics, such as price to earnings ratios, price to sales ratios, and price to book ratios of companies in various sectors relative to historic trends, as well as the relative performance of such sectors, to determine whether a sector is overvalued or undervalued. When the Advisor determines that a particular sector or other segment of the equity market is exhibiting conditions of becoming overvalued, the Advisor may reduce the allocation in that sector and conversely increase the allocation in other sectors that exhibit a more compelling value proposition.

The Advisor may sell an individual equity from the Fund’s portfolio under one or more of the following circumstances:

|

● |

A material change in the company’s structure or management; |

|

● |

A material change in the industry, sector, or economic factors affecting that industry; |

|

● |

A position has doubled in weight; |

|

● |

Analysts’ estimates of future earnings of the company have decreased by more than 5%; |

|

● |

The price has become overvalued by 20% or more based on the Advisor’s proprietary cash flow models; or |

|

● |

To take advantage of price swings caused by market volatility or events due to the foregoing circumstances. |

The Fund may also invest in foreign issuers with securities listed on U.S. exchanges or sponsored ADRs when, in the Advisor’s opinion, such investments would be advantageous to the Fund and help the Fund achieve its investment objective. The Fund will also buy and sell options, from time to time, to seek to provide protection on individual holdings or on the portfolio as a whole. However, there is no guarantee any option strategy will meet the intended objective. Option strategies may include but not limited to: buying put option on a stock, or Underlying ETF or index to seek protection for a portion of the portfolio; writing puts to generate income while waiting for a stock price to become more reasonable; and writing covered calls to generate income on stock positions that the Advisor believes are becoming overvalued.

2

The Advisor’s investment philosophy is grounded by an appreciation of risk. The Advisor believes that it is possible to identify growing companies or sectors by trends in past and forecasted revenues and earnings. However, in selecting individual equities, it is important to select only those companies that have a sustainable business model through various economic conditions. A sustainable business model is one that is focused on organic growth supplemented by acquisitions and capital investment. The Advisor believes a strong business model creates shareholder wealth, as measured by the return on equity that a company produces. A company that produces a reliable stream of cash from operating activities can succeed in economically challenging times.

The portion of the Fund’s net assets invested at any given time, either directly or via an Underlying ETF, in securities of issuers engaged in industries within a particular sector is affected by valuation considerations and other investment characteristics of that sector. As a result, the Fund’s investment in various sectors generally will change over time, and a significant allocation to any particular sector does not necessarily represent a continuing investment policy or investment strategy to invest in that sector.

PRINCIPAL RISKS

The Fund’s share price will fluctuate. You could lose money on your investment in the Fund, and the Fund could also return less than other investments. The Fund is subject to the principal risks listed below.

Stock Market Risk

The return on and value of an investment in the Fund will fluctuate in response to stock market movements. Stocks and other equity securities are subject to market risks, such as a rapid increase or decrease in a stock’s value or liquidity, and fluctuations in price due to earnings, economic conditions and other factors beyond the control of the Advisor. A company’s share price may decline if a company does not perform as expected, if it is not well managed, if there is a decreased demand for its products or services, or during periods of economic uncertainty or stock market turbulence, among other circumstances. As a result, the value of your investment in the Fund will fluctuate with the market, and you could lose money over short or long-term periods.

Capitalization Risk

Large cap companies may be unable to respond as quickly as smaller companies to new competitive challenges, such as changes in technology and consumer tastes, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

ETF Risk

ETFs are subject to investment advisory fees and other expenses, which will be indirectly paid by the Fund. As a result, your cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other funds that invest directly in equity and fixed income securities. Each ETF is subject to specific risks, depending on the nature of the ETF. ETF shares may trade at a discount to or a premium above net asset value if there is a limited market in such shares. ETFs are also subject to brokerage and other trading costs, which could result in greater expenses to the Fund.

American Depositary Receipt Risk

ADRs involve risks similar to those associated with investments in foreign securities, such as changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies. Depositary receipts listed on U.S. exchanges are issued by banks or trust companies and entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares (“Underlying Shares”). When the Fund invests in ADRs as a substitute for an investment directly in the Underlying Shares, the Fund is exposed to the risk that the depositary receipts may not provide a return that corresponds precisely with that of the Underlying Shares.

Foreign Investment Risk

Investments in foreign issuers involve risks that may be different from those of U.S. issuers. Foreign issuers may not be subject to uniform audit, financial reporting or disclosure standards, practices or requirements comparable to those found in the United States. Foreign issuers are also subject to the risk of adverse changes in investment or exchange control regulations, expropriation or confiscatory taxation, limitations on the removal of funds or other assets, political or social instability, and nationalization of companies or industries. In addition, the dividends payable by certain of the Fund’s foreign issuers may be subject to foreign withholding taxes.

Options Risk

There are risks associated with the sale and purchase of call and put options. In general, option prices are highly volatile and may fluctuate substantially during a short period of time. As a seller (writer) of a put option, the Fund will tend to lose money if the value of the reference index or security falls below the strike price. As the seller (writer) of a call option, the Fund will tend to lose money if the value of the reference index or security rises above the strike price. As the buyer of a put or call option, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option. Certain options in which the Fund may invest may be traded (and privately negotiated) in the Over-the-Counter (“OTC”) market. The OTC market is largely unregulated. As a result and similar to other privately negotiated contracts, the Fund is subject to counterparty credit risk with respect to such option contracts.

3

Option premiums are treated as short-term capital gains and when distributed to shareholders, are usually taxable as ordinary income, which may have a higher tax rate than long-term capital gains for shareholders holding Fund shares in a taxable account.

Global Market Risk

An investment in shares is subject to investment risk, including the possible loss of the entire principal amount invested. The Fund is subject to the risk that geopolitical and other similar events will disrupt the economy on a national or global level. For instance, war, terrorism, market manipulation, government defaults, government shutdowns, political changes or diplomatic developments, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and natural/environmental disasters can all negatively impact the securities markets.

COVID-19

The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide.

Investment Style and Management Risk

The Fund’s method of security selection may not be successful and the Fund may underperform relative to other mutual funds that employ similar investment strategies. The Fund’s style may go out of favor with investors, negatively impacting performance. In addition, the Advisor’s screening process may select investments that fail to appreciate as anticipated.

Sector Risk

At times when the Fund emphasizes investment in one or more sectors represented in the S&P 500 Index, the value of its net assets will be more susceptible to the financial, market or economic events affecting issuers and industries within those sectors than would be the case for mutual funds that do not hold investments in those particular sectors. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s net asset value per share.

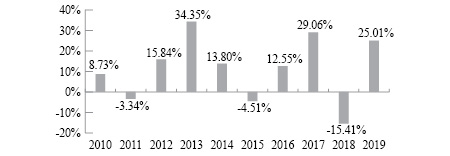

PERFORMANCE SUMMARY

The bar chart and performance table that follow provide some indication of the risks of investing in the Fund by showing the Fund’s performance for each full calendar year over the lifetime of the Fund, and by showing how the Fund’s average annual total returns for one year, five years and since inception compared with a broad measure of market performance. How the Fund has performed in the past (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. All performance information shown reflects management fee reductions and/or expense reimbursements by the Advisor; without such management fee reductions and/or expense reimbursements, returns would have been lower. Updated performance information, current through the most recent month end, is available by calling 1-866-420-3350.

Annual Total Returns

The year-to-date total return for the Fund through March 31, 2020 was -20.50%.

During the period shown in the bar chart above, the highest return for a calendar quarter was 14.74% (quarter ended March 31, 2012) and the lowest return for a calendar quarter was -20.50% (quarter ended March 31, 2020).

Average Annual Total Returns for Periods Ended December 31, 2019

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

|

|

1 Year |

5 Years |

10 Years |

|

AlphaMark Fund1 |

|||

|

Return Before Taxes |

25.01% |

7.96% |

10.57% |

|

Return After Taxes on Distributions |

24.43% |

5.50% |

8.52% |

|

Return After Taxes on Distributions and Sale of Fund Shares |

15.21% |

5.82% |

8.26% |

|

S&P |

31.49% |

11.70% |

13.56% |

| 1) | These returns reflect the performance of the Fund prior to the change in its investment strategy in August 2020. |

| 2) | The S&P 500 Index is a capitalization-weighted, unmanaged index of 500 large United States companies chosen for market capitalization, liquidity and industry group representation and includes reinvested dividends. You cannot invest directly in an index. |

4

MANAGEMENT OF THE FUND

AlphaMark Advisors, LLC (the “Advisor”)

Portfolio Manager

Michael L. Simon, President and Chief Investment Officer of the Advisor, is primarily responsible for the day-to-day management of the Fund’s portfolio and has acted in this capacity since the Fund’s inception in October 2008.

PURCHASE AND SALE OF FUND SHARES

Minimum Initial Investment

$1,000 (except $500 for IRAs or gift to minors’ accounts)

Minimum Subsequent Investments

$100 (all accounts)

General Information

You may purchase or redeem (sell) shares of the Fund on each day that the New York Stock Exchange is open for business. Transactions may be initiated by written request, by telephone or through your financial intermediary.

TAX INFORMATION

The Fund’s distributions are generally taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA. If you are investing through a tax-deferred arrangement, you may be taxed later upon withdrawal of monies from those accounts.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5