Chart created with TradingView

Fundamental Euro Forecast: Bearish

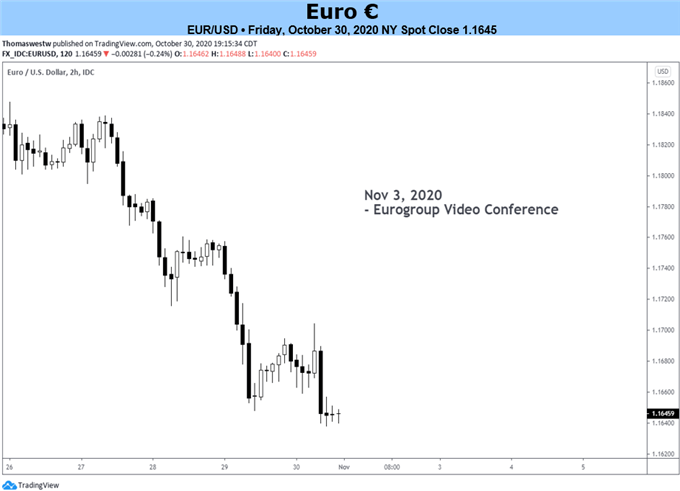

- The European Central Bank dropped the strongest possible hint last Thursday that it’s planning to ease Eurozone monetary policy still further in December.

- EUR/USD is well supported at the 1.16 level but, if that breaks, substantial further losses look likely.

Downside beckons for Euro

EUR/USD is in danger of dropping sharply if strong support at 1.16 breaks. The recent low for the pair was at 1.1611, touched on September 25, and the price was last below that level back on July 24; meaning it has now traded for more than three months in a broad 1.16 to 1.20 range.

The 1.16 level is therefore of crucial importance, with little further long-term support for EUR/USD ahead of the lows just under 1.12 reached in late June and on the first day of July.

EUR/USD Price Chart, Daily Timeframe (April 29 – October 29, 2020)

Source: Refinitiv (You can click on it for a larger image)

Recommended by Martin Essex, MSTA

Download our Q4Euroforecast

ECB to ease Eurozone monetary policy still further in December

These numbers have been brought into focus by the European Central Bank’s strong hints last Thursday that it will ease Eurozone monetary policy still further in December to help offset the economic damage from the Covid-19 pandemic, which is flowing over the area for a second time and forcing Eurozone nations to impose new lockdowns.

While nothing was spelt out in the ECB’s statement after it decided to leave policy on hold, or by ECB President Christine Lagarde in her subsequent news conference, there can be little doubt about its intentions. Lagarde noted that the economy is losing momentum faster than expected, that consumers are cautious in light of the pandemic, that uncertainty is weighing on business investment, that inflation has been dampened by lower energy prices and that risks are clearly tilted to the downside.

That means the only key question for December, unless everything changes between now and then, is how not whether the ECB will ease policy. Most likely is an expansion/extension of its pandemic emergency purchase program (PEPP) that was introduced in March. However, it might also improve the terms of its latest targeted longer-term refinancing operations (TLTROs) and even interest rate cuts cannot be ruled out entirely. The ECB’s deposit rate has been at minus 0.5% since September 2019, and will likely stay at that level, but a further reduction to minus 0.6% is possible but unlikely.

This all seems likely to weaken the Euro in the weeks ahead, even though easing monetary policy is not as clear a negative for a currency as it has been in the past. On the other hand, of course, if 1.16 holds, there is no reason why EUR/USD should not climb back to around the middle of its trading range, close to 1.18.

Eurozone week ahead: PMIs

In the meantime, there are few Eurozone data points of note on the calendar in the coming week – a week that will be dominated by the US elections and therefore the USD side of the EUR/USD equation. Final October purchasing managers’ indexes for the manufacturing and services sectors of the Eurozone and many of its constituent nations are due on Monday and Wednesday respectively, but will almost certainly be ignored as the election takes center stage.

| Change in | Longs | Shorts | OI |

| Daily | -5% | -2% | -3% |

| Weekly | 41% | -34% | -12% |

If you’d like to find out more about how central banks impact the FX market, check out this guide

We look at currencies regularly in the DailyFX Trading Global Markets Decoded podcasts that you can find here on Apple or wherever you go for your podcasts

— Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex