- Traders bet on the ECB starting rate cuts from March 2024.

- The euro is down 1% this week, marking its most significant weekly decline since May.

- US private payrolls rose less than anticipated in November.

Thursday witnessed the euro descending to its lowest level in over three weeks, shaping a bearish EUR/USD outlook as traders bet on the ECB rolling out rate cuts starting in March 2024. Meanwhile, the dollar remained stable ahead of crucial payroll data this week.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The euro is down 1% this week, marking its most significant weekly decline since May. Traders estimate an 85% likelihood of the ECB cutting interest rates in the March meeting. Moreover, they are pricing in nearly 150 basis points of easing by the end of next year.

Meanwhile, a Reuters poll indicates that most economists expect the ECB to cut rates in the second quarter of next year.

In an interview published on Wednesday, ECB member and Bank of France head Francois Villeroy de Galhau hinted at the possibility of a rate cut starting in 2024. Additionally, he cited a faster-than-expected disinflation. The ECB is expected to keep interest rates at the current record high of 4% next week. However, the focus will shift to officials’ comments about the rate outlook.

Elsewhere, data showed that US private payrolls rose less than anticipated in November, signaling a gradual cooling in the labor market. Investors will closely monitor Friday’s non-farm payrolls data for a clearer view of the labor market.

Softening economic data and comments from Fed officials have fueled expectations that the central bank is concluding its rate-increase cycle and might start cutting rates as early as March.

EUR/USD key events today

- The US Initial Jobless Claims report

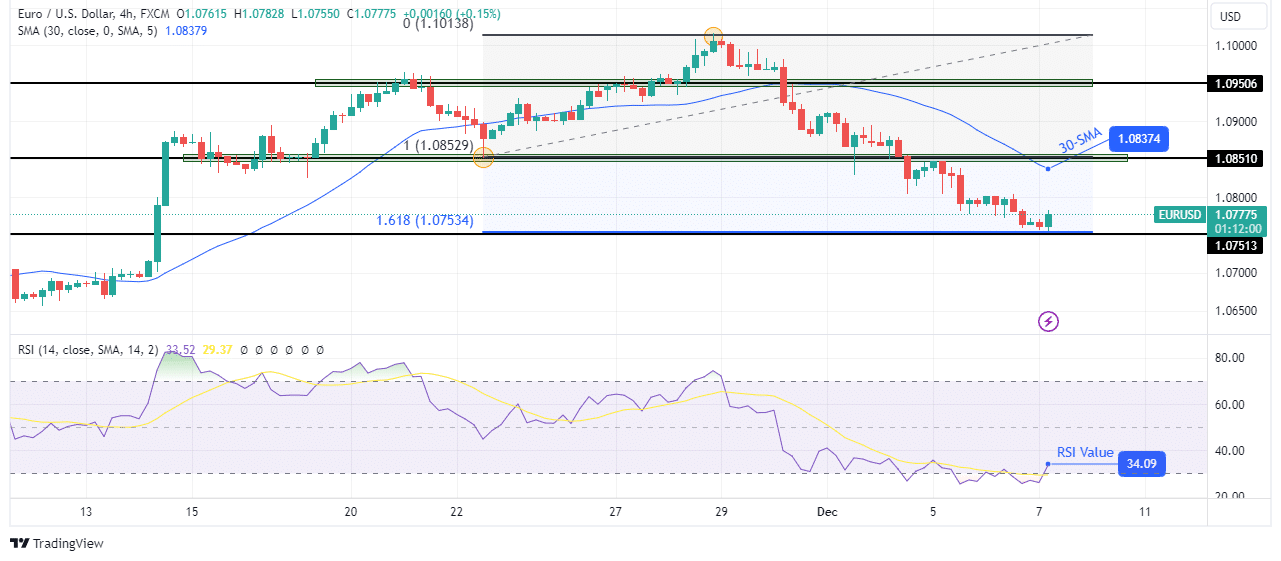

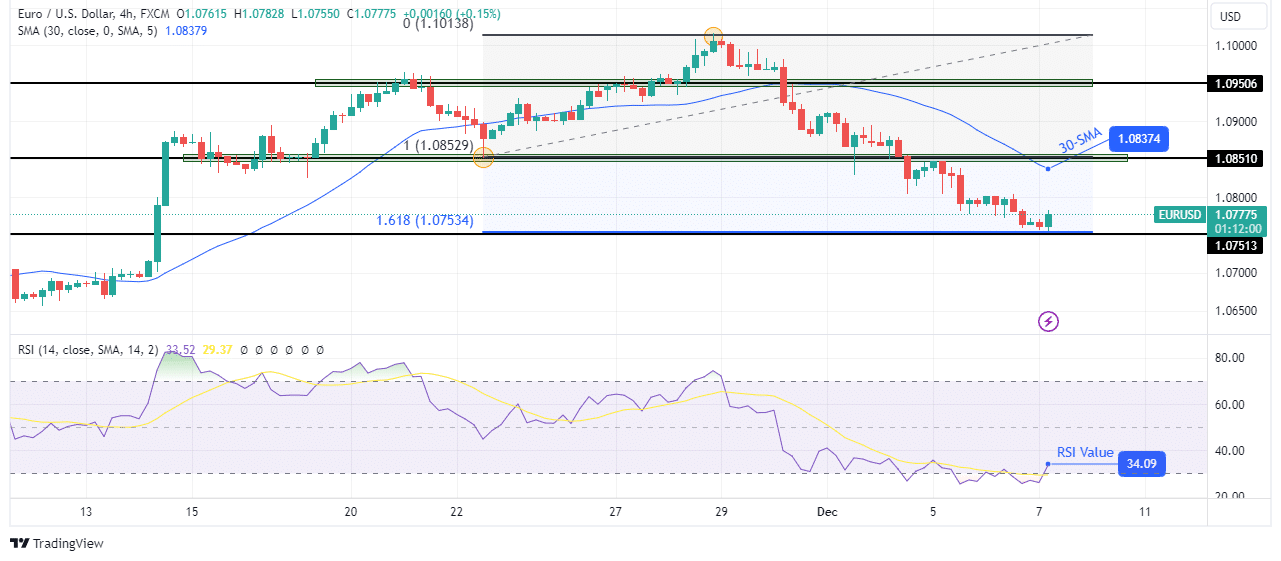

EUR/USD technical outlook: Buyers ready for a comeback at 1.618 Fib extension

After breaking below the 1.0851 key support level, EUR/USD has collapsed to the 1.0751 support. There is a solid bearish bias, supported by the 30-SMA, which trades far above the price. At the same time, the RSI has held near the oversold region, indicating strong bearish momentum.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

However, the price has collapsed without making any significant retracements. Therefore, strong support might lead to a deeper pullback for EUR/USD before the downtrend continues. Notably, the price is near the key 1.618 fib extension level. This and the 1.0751 level will likely be strong enough to trigger a deep pullback.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.