FrankvandenBergh

Currency Exchange International “CXI” (OTCPK:CURN) is a Canadian financial services company which trades over the counter with a market cap slightly above $100 million. While much of CXI’s retail business was shut down during COVID, CXI pivoted from focusing on selling foreign banknotes to consumers into a B2B bank operating a sizable SaaS business. I think that the market has yet to fully appreciate the growth potential of these new initiatives and realize that CXI is no longer just selling your uncle his Euros at the airport. As these new divisions of the business grows, and investors catch up to the changing mix of CXI’s business, I think the stock could rerate higher, delivering a gain of several hundred percent over the next three years. Below, I outline this thesis, first by showing how it checks the boxes for a small-cap growth investment as outlined by Peter Lynch and others, and then showing how the business has transformed over the last few years. I then list several catalysts which could drive growth and model potential valuations.

Since this is an illiquid, microcap bank, exposed to global trade, travel, and financial markets, the risk is high. Shares dropped by over 50% during the pandemic. Nonetheless, I think the potential for a 100%-200% total return over the next three years justifies this risk, and I am planning to buy shares. In recent micro-cap screens, CURN was the second-most promising company I found (after MAMA, which I wrote about recently). I am rating CURN a STRONG BUY with a price target of $36.

Several types of stocks look undervalued going into 2024: (1) small-caps, (2) financials, and (3) equities outside the U.S. After a 2023 rally led by the Magnificent Seven in which the Nasdaq soared and the Russell 2000 lagged, small caps look cheap. And most bank stocks have yet to recover from their spring drop during the SVB crisis. Many foreign markets also have underperformed U.S. ones over the last several years – the TSX is trading at a P/E of 12, about half that of the U.S. market. CXI has been undervalued for several compounding reasons.

The Basics

1: Moderate valuation implies slow growth

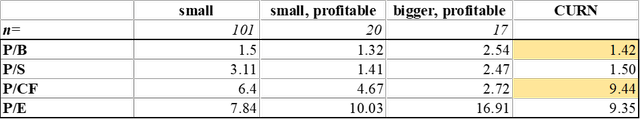

Looking at competitors, CXI seems fairly valued. But in light of the company’s past multiples and growth rates, it’s clearly trading at a substantial discount.

CXI is currently trading around twice the price it IPOed at in 2013. In the mid-2010s, revenue doubled, and shares traded around $20. But then the company operated at a loss during the pandemic, revenue halved, and shares tumbled back to $8. Since 2020, revenue has increased nearly 4x, and earnings have increased 3x. Meanwhile, shares are up 2x. As a result, CXI is trading at the lowest P/E and P/S multiples ever. On a sales and earnings basis, it is trading at about one third of its pre-COVID valuation. Shares could rise to $55 based on multiple normalization alone.

Relative to its industry, CXI is trading at average multiples.

(data downloaded 12/26/2023. Small companies have market caps less than $1bn; bigger ones have market caps of $1-$5bn)

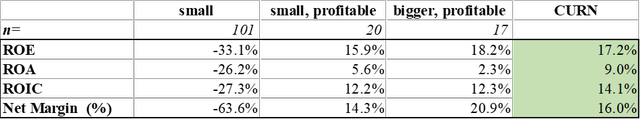

CXI’s slight premium is explained in part by superior profitability.

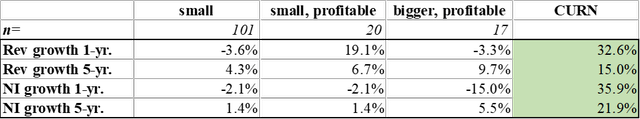

CXI is also growing faster. Since 2014, revenue and net income have grown at a CAGR above 20%. The share count has increased at 2% per year (which will hopefully slow due to a recently announced plan to buy back shares). As a result, EPS has grown at only 12% per year. But even so, CXI is a growing company which is being priced like a stagnant one.

2: CXI is small, boring, and ignored

CXI is almost entirely off the radar of the professional investing community. No one has covered the stock on Seeking Alpha in over a year. Only one investing group is covering it. There is only one analyst issuing estimates. On the latest earnings call, there were three analysts. As far as I can tell, there is little institutional ownership. According to Etrade, there are seven large block shareholders who own 25.6% percent of shares. Since the CEO himself owns ~20% of shares, I surmise that funds only own about 5% of shares.

There are many reasons that CXI is unappreciated by the market. First, it is a micro-cap which trades over the counter.

Second, it is complex and boring. On the Q2 call, CXI’s CEO answered a question about this, saying “…people are confused with, well, are you a bank, are you a fintech, are you just a currency exchange?” I personally think of CXI selling foreign currency (banknotes) to travelers – a dying business. Attach this to a regional bank and an opaque business services company, and it makes CXI hard to understand or model. This difficulty is compounded by the fact that the company does not break down its income statement by operating segment, so it is hard to measure growth rates and margins.

Third, CXI operated at a loss during the pandemic, and valuations are still recovering. This process has been slowed by the SVB failure this spring.

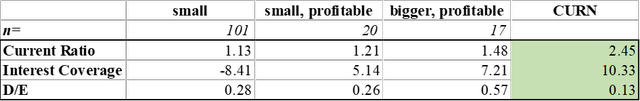

3: The Balance Sheet is Solid

As of the Q3 earnings call, CXI has a Tier 1 capital ratio of 24.3% and a total capital ratio of 34.5% By comparison, most large U.S. banks have Tier 1 ratios ~12 and total capital ratios ~15%. In other words, CXI has about twice as much capital as a large American bank. Compared to its more direct competitors, CXI is in a significantly stronger financial position. CXI has around $10 million in debt compared to nearly $100 million in cash. While some of this cash is used as inventory and reserves, more than enough of it could be used to pay its debts in a crisis. On the Q3 call, Randolph Pinna explicitly addressed this point, saying that “we’re taking it quite conservatively. We are a Canadian Bank, as you know, the Canadian Banking System is very sound and very risk averse.”

4: Randolph Pinna is a classic Owner-Operator

CXI CEO Randolph Pinna founded the predecessor of CXI in 1987. While I have been unable to definitively verify his age, several personal information websites say that he is 54. According to LinkedIn, he started college in 1991. Pinna is probably in his mid-to-late 50s. This means that he probably has at least another decade left at CXI. The strongest reason to think that he will stay and generate more shareholder value is that he owns 20% of shares. His stake is probably worth at least $20 million, many times his annual salary. In 2022, combined executive compensation at CXI was less than $5 million.

Moreover, it seems that Pinna is running the business well. He has a 96% approval rating on Glassdoor and CXI has very high ratings from its employees and its customers: Glassdoor: 4.5. Indeed: 4.2. Trustpilot: 4.5. After laying people off, automating tasks, and cutting salaries in 2021, CXI increased wages twice in 2022. To me, this is convincing evidence that Pinna has built CXI into an organized and effective company.

The Business

CXI facilitates foreign exchange payments and banknote transfers. They have six vaults to hold foreign currency and deliver it across the U.S. and Canada. For consumers, who account for (I estimate) about 60-70% of sales, they offer banknotes at around 200 retail locations and through a D2C mail business. For corporations and financial services companies, they offer banknotes (about 15% of sales) and FX payment management software (about 15% of sales). They have about 2,500 corporate and financial clients.

Over the last two years, the retail business has recovered from COVID, and the wholesale (corporate + financial) business has accelerated. I think this is a classic “melting ice cube” story.

1: The retail business is in a declining industry

CXI has an entrenched position in this market, and a good operating model, but the industry is shrinking. I think that CXI will be able to expand their business slightly as they take market share over the next few years, but then the business will go into permanent decline.

CXI’s main competitors are Wells Fargo and Bank of America. During COVID, a fourth competitor, Travelex, went bankrupt and left the U.S. market. Today, CXI is the only supplier of foreign currency in many US airports. As travel has recovered since COVID, sales have improved. Going forward, this business is expected to decline, as cash becomes less widely used. But I think that there could be a ‘long tail’ on its use, since people still use cash when they first arrive in a new place. What matters here is not the digital payment system adoption in the home country, but in the target country. If you are travelling from the U.S. to Mexico, will you be able to buy digital pesos in the United States? Will your financial apps work in your target destination?

CXI is much smaller than Bank of America or Wells Fargo, but they have some advantages. By my calculation, the spread between spot rates and offered rates was about 50-75% higher for CXI than for Bank of America. Otherwise, their services were similar. But the catch is that Bank of America and Wells Fargo only offer this business to their own customers, who total something like 80-100 million people. This leaves a huge number of Americans who lack the option of ordering foreign currency through their bank. And I don’t think that they will expand their offerings. This is a small business for these huge banks, and they seem to offer it only as a courtesy to their customers. Another option is to withdraw local currency directly from an ATM, but the rates on these transactions are probably worse. In short, CXI charges a small premium for convenience.

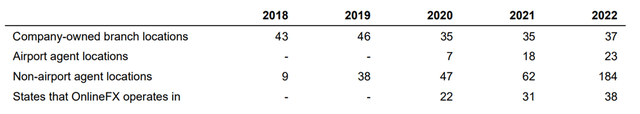

Over the last decade, this business has expanded significantly. In 2013, CXI had 26 retail locations and 23 affiliates. During COVID, when Travelex went bankrupt, CXI took over and rebranded many of their stores. Today, while CXI operates about 40 company-owned stores, they have a much larger number of agent locations, for which they provide branding, back-end support, and currency supplies. Since in this arrangement CXI avoids leasing and payroll costs and has local monopolies, margins are better and there is less financial risk for CXI. Moreover, since partners (like Duty Free) already operate in airports around the world, this has the potential to drive continued growth much more rapidly and smoothly than if CXI was opening their own stores.

I think it is fair to assume that they will be able to continue increasing locations at a slow rate and increase market share through marketing. They have a new contract to operate out of Duty-Free stores on the U.S.-Mexico border. There are around 100-200 international airports in the U.S., leaving some room for further U.S. expansion. More recently, they have expanded their mail order D2C business, and it is growing fast. CXI now offers home delivery to 92% of the U.S. population. In the future, CXI could expand and open partner locations in the roughly 1,000 international airports abroad.

2: The payments business is growing

The second part of the business is international payment management for corporations and financial institutions. CXI’s software package helps clients buy and sell foreign currency, manage currency risk, and facilitate compliance with foreign exchange laws. CXI started this over a decade ago. From 2017 to 2022, it grew from about 3.5% to 19% of revenue; revenue in this segment grew at 60% per year. Their client count increased by 21% per year, indicating that CXI not only won new customers, but also won bigger accounts with higher transaction volumes. In a Q2 survey, it received a Net Promoter Score of 85 (compared to 71 for competitor MoneyCorp). Here is how the company describes it in their 2022 annual report:

The Company has developed CXIFX, its proprietary, customizable, web-based software, as an integral part of its business and believes that it represents an important competitive advantage. CXIFX is also an online compliance and risk management tool that integrates with core bank processing platforms to allow a seamless transaction experience. This includes an OnlineFX platform that allows it to market foreign exchange products directly to consumers that operate in 38 states. The trade secrets associated with CXIFX are protected via copyright, restricted access to both the software and its source code, and secure maintenance of source code by a team of software engineers employed by the Company.

Sell-side reports suggest that the foreign exchange services industry will grow by 7-10% over the next five years. Since CXI only had about 2,500 clients in 2022, there is lots of room to grow. It is hard to assess potential growth, but given the high ratings and explosive growth, I model growth tapering from 15% to 5% over the next five years.

3: EBC has cleared the regulatory hurdles

Third is the subsidiary Exchange Bank of Canada. EBC is a B2B foreign currency provider for financial institutions in the U.S. and Canada. Most small banks do not have the infrastructure to manage foreign currency, and so EBC has a market niche. EBC is small enough to provide good service to small clients. And since it does not do retail banking, it does not compete with them. But it is also creditworthy. In 2016, EBC was chartered as a bank by the Canadian Ministry of Finance, and in 2017 it was accepted for SWIFT membership in 2017. CXI has cleared the regulatory barriers to handling foreign exchange transactions, such as know-your-client and anti-money laundering protocols. EBC only had its first year of profitability in 2022, when revenue reached $17 million (25% of the total).

I think each of CXI’s three business segments has a distinct market niche. CXI may not yet have a sizable moat, but it definitely has a niche. I think this helps explain the company’s high ROA and ROIC.

Catalysts

Recent writings on CXI have focused on costs, scale, and M&A. CXI has nearly $100 million in cash, and most estimates indicate that they could use around $20-30 million of that for an acquisition. But I think M&A will probably be slower than expected. Instead, I would emphasize the growth opportunities at EBC and the payments business.

1: Larger transfers

EBC still only generates a small portion of overall revenues, but the opportunity is large. On the Q1 call, CEO Randolph Pinna said that “the management team, including the Chairman, feels that the bank has potential to become one day bigger than CXI itself, and we all appreciate such a goal.”

There is a large demand for CAD and USD abroad. On the Q4 2022 call, management noted that the amount of USD in circulation globally has doubled in the last decade. And in 2021, EBC was approved to participate in the Federal Reserve’s Foreign Bank International Cash Services (FBICS) program, allows CXI to export USD directly from the Fed. According to the FBICS website, Moneycorp is the only other approved company.

But they have hit a road bump. After the banking crisis in spring 2023, banks became more conservative with their transfer policies. And since many transfers are $10-$50 million dollars each, CXI is too small to underwrite them. The company had one $54 million trade in Q1, but “had to get special approval due to the size of the bank [EBC].” In response, CXI is working to secure a “trust account structure” with a larger bank (they haven’t disclosed whom) to underwrite these transactions for a fixed fee. On the Q3 call, management explained that according to their clients, this will satisfy their credit risk departments. We don’t know exactly when this agreement might get approved, but it seems to be the focal point for management right now.

If and when CXI secures this trust agreement, the opportunity would be significant. Since the funds will flow through CXI’s trust underwriter and the be prepaid by their clients, these payments won’t show up as liabilities on the CXI balance sheet. So CXI could conceivably increase them very quickly. CXI is already in talks with three approved clients for whom a $50 million transfer would be a weekly occurrence. At the 2023 annual meeting, management suggested that the total potential market opportunity here is $400 million (in revenue), and they think that they can capture 20% of it. This would yield $80 million, more than all of CXI’s 2022 revenue. On the Q3 call, management noted that MoneyCorp was able to add $20 million in revenue from this market in their second full year of operation, primarily by serving clients in Europe, the Middle East, and Africa (EMEA).

2: M&A

CXI has a sizable cash position, which could be used for M&A. And they have completed several tuck-in acquisitions in the last five years. On the Q4 2022 call, Pinna noted that the company’s recent reorganization had freed up more of his time to pursue these opportunities, and they had “five active discussions going on” but that “nothing [was] hot enough to announce.” On the Q2 2023 call, Pinna referred to three “quite warm opportunities” especially to augment CXI’s payments business. But most of CXI’s cash is required for the business itself, as Pinna noted on the Q1 call. On the Q3 call, he also resisted the idea of share buybacks. Pinna is an owner-operator, committed to growing his business. Given that there are so few potential acquisitions in the banknotes space, M&A here seems unlikely. While there are probably more opportunities in the payments business, I think management’s caution means that M&A will be smaller and slower than analysts hope.

3: Cost Cuts

CXI’s margins are pretty good and have some room for improvement. The net margin is still more than 20% lower than the average of larger competitors (16% vs. 20.9%). Margins have expanded, and I would expect this to continue as the business grows. This year there were some “one-time” costs, such as increases in headcount, wages, shipping costs, fraud, and implementation costs for NetSuite, Kyriba (a treasury management system), and Alessa (a money-laundering “compliance and fraud detection software”). These changes were part of a reorganization announced in late 2022, and should “normalize” in 2024 and 2025. But given that Pinna is clearly committed to investing in the business and paying competitive wages, and that CXI can’t really raise fees, I think it is unreasonable to expect net margins to expand beyond 20%.

4: Re-rating

There are several catalysts which could prompt a re-rating. The first is a new investor presentation and better guidance from management. In Q2, Pinna said that CXI was working on a new investor deck “to bring new eyeballs and awareness to the company” in Q3 and Q4. If they broke out revenue and profit by segment, investors would be more likely to see the growth in the payments and wholesale banknotes businesses and value shares more highly.

A second reason that the stock could get rerated is that the retail business is getting eclipsed by the payments and wholesale banknote segments. This could (and should) shift market perception of CXI.

5: New business

Looking at CXI’s record over the last 20 years, it is striking how successful Pinna and his team have been at developing new lines of business. The wholesale banknotes and payment services businesses were virtually nonexistent five years ago, and now they have eclipsed the retail business in potential, if not yet in size. While the retail business may be shrinking, I think the market is underestimating Pinna’s ability to make up for it elsewhere. For example, CXI is currently in talks with the Bank of Canada to get approval to export Canadian dollars. And since CXI now has access to USD from the Fed, there is an opportunity for cross-selling with its existing corporate clients. Their goal is to build “Canada’s next great bank.” In Q2, Pinna referred to the goal of building the infrastructure for “the company to double and triple in the next few years.” I think that even if the catalysts I’ve identified don’t all pan out, Pinna is likely to create other opportunities for growth.

Valuation and Risks

1: Models

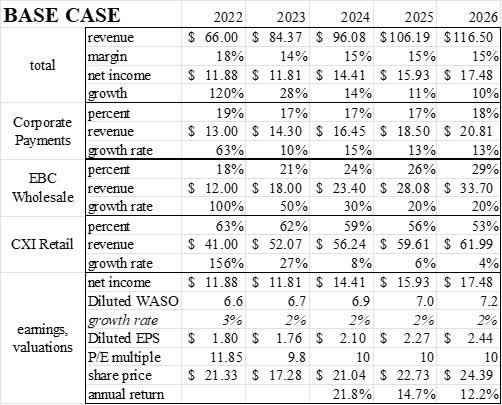

For reasons explained above, my base case includes no margin expansion. To be conservative, I’ve assumed no multiple expansion or M&A. Since CXI has been compounding 20% growth for the last decade and has identified multiple concrete ways to continue growing, I think that modeling 10% top-line growth is conservative. As you can see, even in this scenario, CXI is a promising investment.

the author

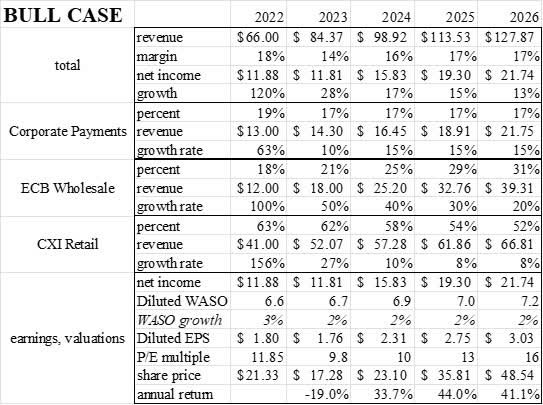

In my bull case, I assume that growth proceeds according to plan. This still implies growth rates significantly below CXI’s historical average. I assume that margins improve slightly, and that growth prompts a market re-rating.

the author

My $35 price target is the average of these two scenarios. Given CXI’s track record, I think the bull case is very plausible.

2: Bear Case & Risks

Given that CXI’s business would dry up if there was a hot war, trade war, or halt to global travel, it is not very meaningful to outline a specific bear-case scenario. Instead, I would say that (1) the balance sheet was solid enough to weather crises in 1999, 2008, 2020, and remains very strong today; and (2) investors should expect losses of over 50% if there were to be a comparable crisis in the future. CXI is a high-risk investment. It is small and traded OTC, both of which add liquidity risk. Average daily volume is about $50,000. A more extended list would include:

- Currency risk – most business is in USD, but CXI is Canadian

- Regulatory risk – CXI has had regulatory delays before, and could again

- Disruption by crypto – if it is adopted more widely by individuals, companies, or central banks, crypto could displace companies like CXI

- USD demand – USD demand may decrease due to downgrades

- Banking system – bank failure could halt the global payments system

- Global commerce –a major war or crisis would disrupt the business

- Execution – CXI could be too conservative to pursue aggressive growth

- Competition – from larger banks or others providing similar services

In short, an economic or political crisis in the America

Bottom Line

I think that CXI will be able to weather a major crisis and has a management team and business model capable of driving sustained growth for the next five years. If growth continues, and if the P/E multiple expands in response, shares could appreciate significantly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.